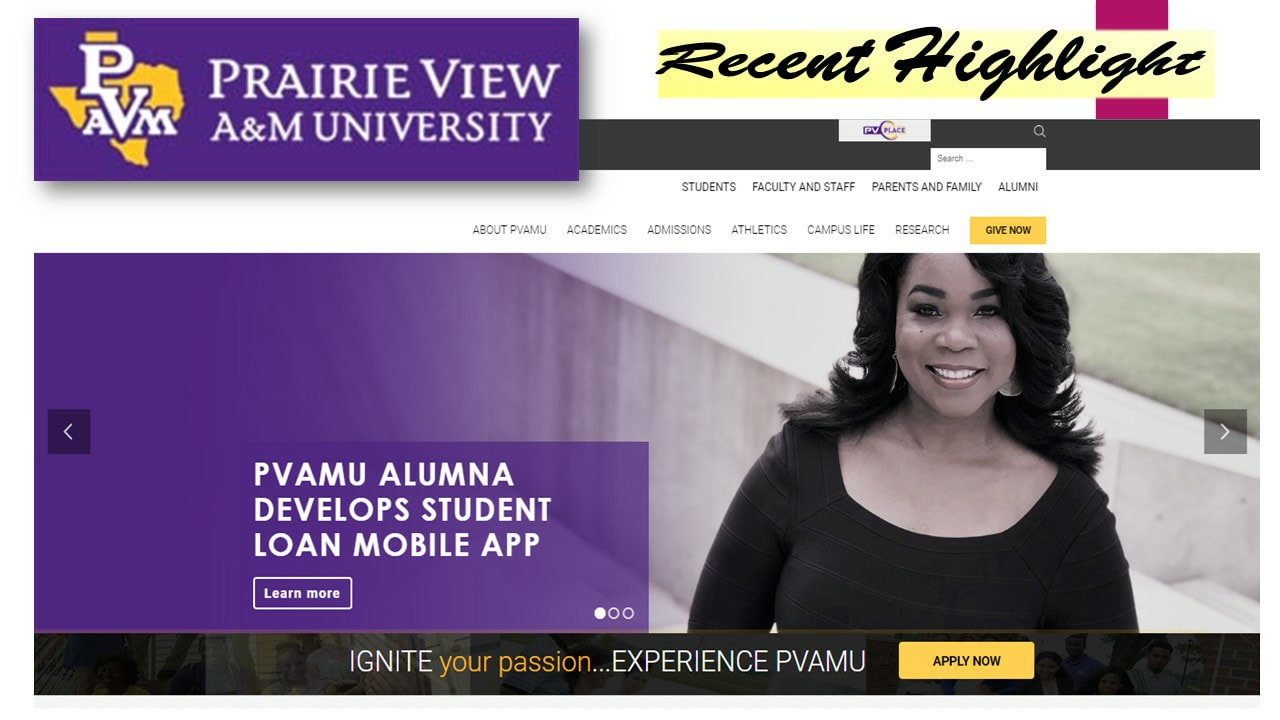

Dr. Tania White developed the app "4 Steps 4 Success" in response to a need that plagues not only the African American community, but our society as a whole. Over 44.2 million people in America have student loan debt and of that amount, 11% of those with student loan debt are either delinquent or have defaulted on their student loans. Many times, the delinquencies and defaults are not intentional, but stem from individuals just not knowing what to do about their surmounting debt that continues to accrue interest each year.

There are companies and banking institutions that offer to help individuals with their student loan debt, however the fees that they charge cost individuals hundreds of dollars upfront and have no guarantees. Those companies often target students that are coming right out of school or they target those individuals that have fallen behind on their student loan payments. Those companies advertise that they can help consolidate student loan debt into one payment and they advertise by saying, “Call us today to see if you qualify to have your monthly payments reduced or even eliminated…” The problem lies in the fact that in order for the companies to help, they must have access to all accounts and personal information of individuals they are helping (i.e. social security numbers, driver’s license numbers, date of birth, etc.). Students (people) that are overwhelmed with the idea of debt will often release their personal information and pay the fees to get help. I know this because those companies have reached out to me and my family and I am familiar with their tactics.

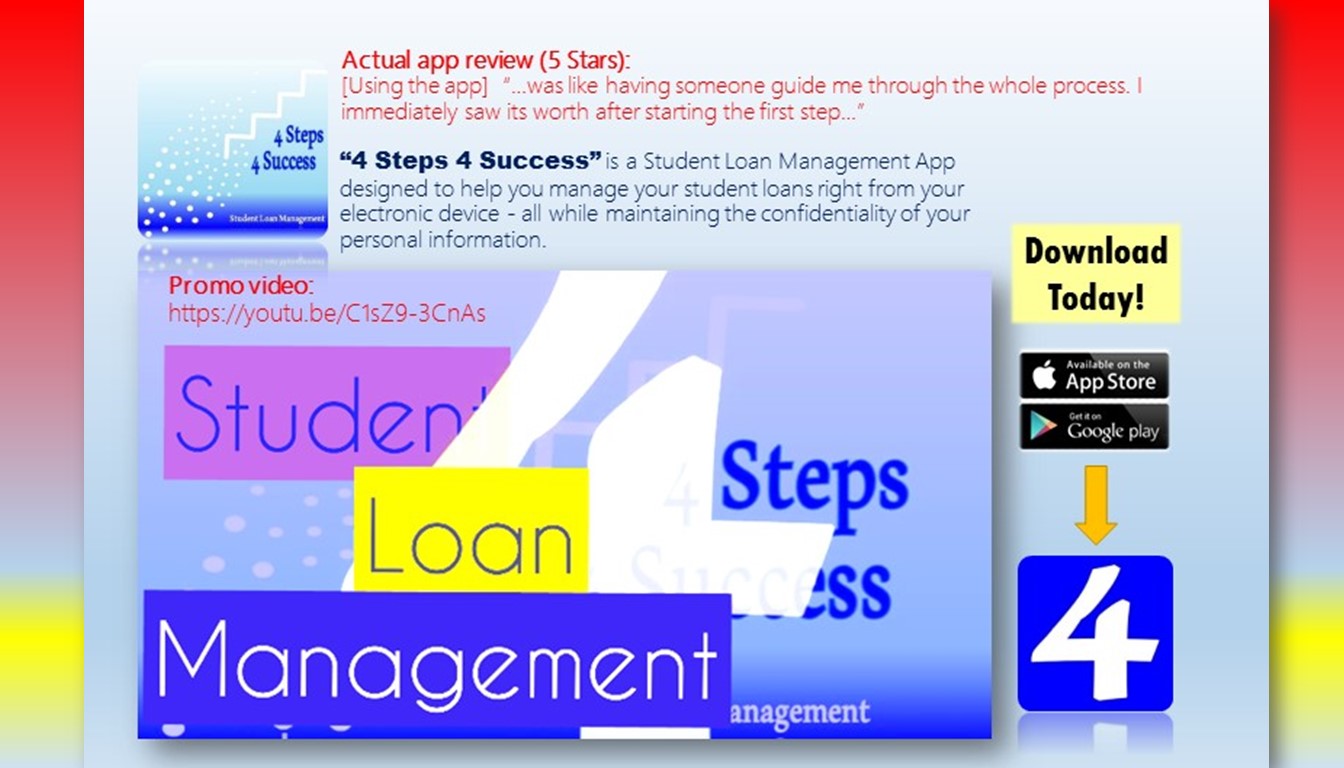

Dr. White did extensive research on student loan debt and from that research, she developed the app, “4 Steps 4 Success” as a way to help individuals manage their student loans from the convenience of their personal device. The app contains step by step instructions on how individuals can become aware of all the student loans that have been issued to them, the providers they have been assigned, live links for individuals to actually apply for loan consolidation, live links for individuals to apply for income-driven repayment options, and access links to loan forgiveness information. Everyone who has had a student loan issued can benefit from using the app if they are interested in managing the debt they have. Dr. White developed this app based on a vision she had and steps she personally took to manage her own student loan debt. Dr. White also used those steps to help others, including her own son that attended college for 3 years prior to enlisting into the United States Air Force.

The goal of the app is to help individuals manage their student loan debt without having to outlay hundreds of dollars and without having to release their personal information to anyone. The app helps individuals become aware of the loans they have accumulated, guides them to the various options out there to help with their loan debt, and provides a solution to young adults that feel defeated coming out of college because they just don’t know what to do next. The feedback Dr. White has received from college students has been phenomenal and she is confident that many individuals (students and adults alike) can benefit from the application. Knowledge is power and if more students are knowledgeable of how to manage their student loan debt, then that will manifest into more adults being knowledgeable, thus decreasing the deficiency and default rates. This knowledge will also build confidence in our youth so they will not be afraid to complete their degrees and move forward in life with their student loans. It is shocking to know that some of our African American students drop-out of college because they became overwhelmed with the amount of student loan debt they accumulate each semester! Educating them on all of the various options available could have help them lessen their stress by knowing there are options available to offset that debt.

Watch the video to see how the app works!

There are companies and banking institutions that offer to help individuals with their student loan debt, however the fees that they charge cost individuals hundreds of dollars upfront and have no guarantees. Those companies often target students that are coming right out of school or they target those individuals that have fallen behind on their student loan payments. Those companies advertise that they can help consolidate student loan debt into one payment and they advertise by saying, “Call us today to see if you qualify to have your monthly payments reduced or even eliminated…” The problem lies in the fact that in order for the companies to help, they must have access to all accounts and personal information of individuals they are helping (i.e. social security numbers, driver’s license numbers, date of birth, etc.). Students (people) that are overwhelmed with the idea of debt will often release their personal information and pay the fees to get help. I know this because those companies have reached out to me and my family and I am familiar with their tactics.

Dr. White did extensive research on student loan debt and from that research, she developed the app, “4 Steps 4 Success” as a way to help individuals manage their student loans from the convenience of their personal device. The app contains step by step instructions on how individuals can become aware of all the student loans that have been issued to them, the providers they have been assigned, live links for individuals to actually apply for loan consolidation, live links for individuals to apply for income-driven repayment options, and access links to loan forgiveness information. Everyone who has had a student loan issued can benefit from using the app if they are interested in managing the debt they have. Dr. White developed this app based on a vision she had and steps she personally took to manage her own student loan debt. Dr. White also used those steps to help others, including her own son that attended college for 3 years prior to enlisting into the United States Air Force.

The goal of the app is to help individuals manage their student loan debt without having to outlay hundreds of dollars and without having to release their personal information to anyone. The app helps individuals become aware of the loans they have accumulated, guides them to the various options out there to help with their loan debt, and provides a solution to young adults that feel defeated coming out of college because they just don’t know what to do next. The feedback Dr. White has received from college students has been phenomenal and she is confident that many individuals (students and adults alike) can benefit from the application. Knowledge is power and if more students are knowledgeable of how to manage their student loan debt, then that will manifest into more adults being knowledgeable, thus decreasing the deficiency and default rates. This knowledge will also build confidence in our youth so they will not be afraid to complete their degrees and move forward in life with their student loans. It is shocking to know that some of our African American students drop-out of college because they became overwhelmed with the amount of student loan debt they accumulate each semester! Educating them on all of the various options available could have help them lessen their stress by knowing there are options available to offset that debt.

Watch the video to see how the app works!

"Stress is always prevalent, it's how you deal with it that counts!”